At Zax Finance, we take the hassle out of international payments and foreign currency management.

Making it easier to do business across borders

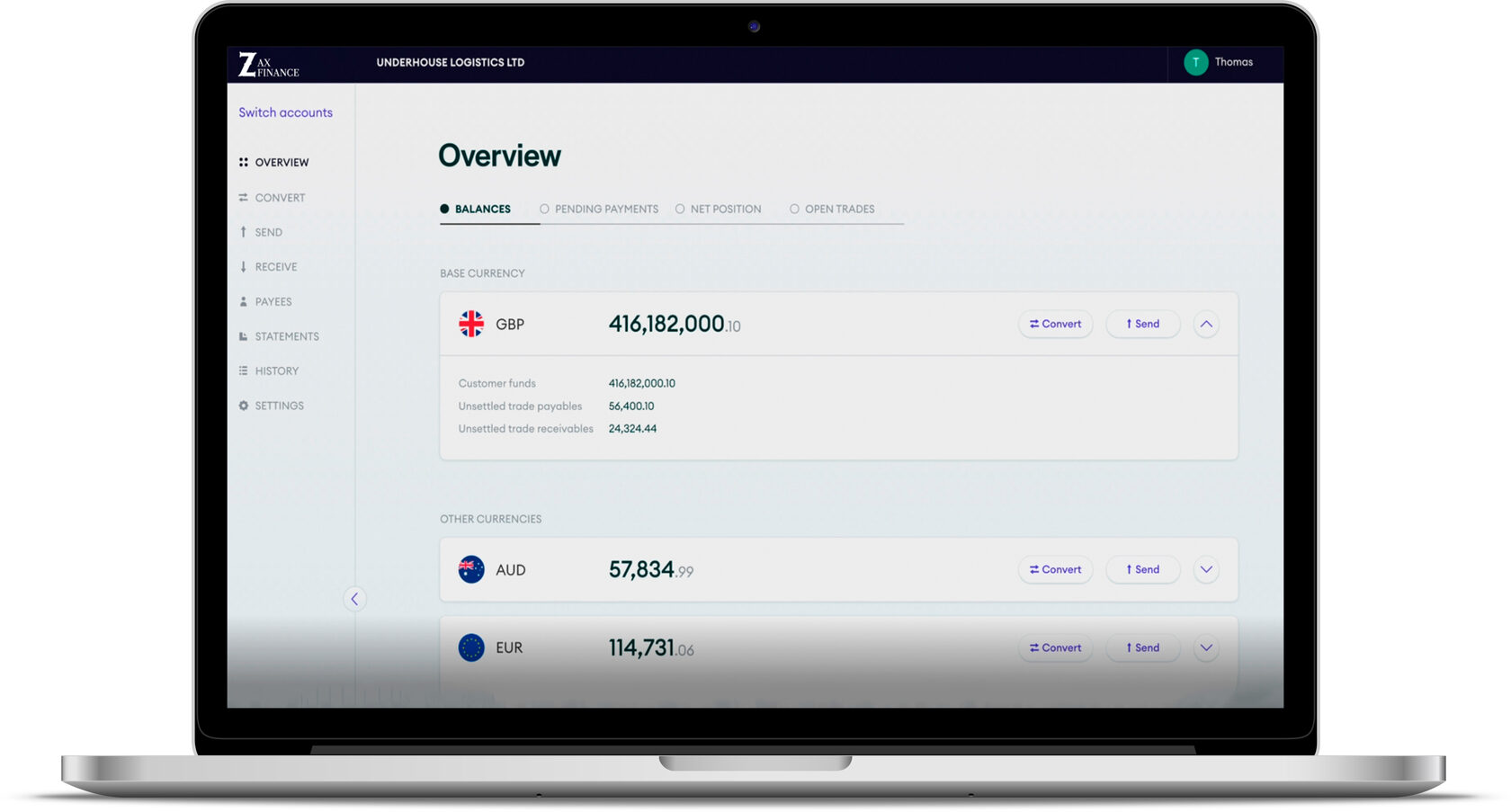

Multi-currency accounts for businesses

Fixing a transaction

at the current exchange rate

at the current exchange rate

Security of your bank-level account

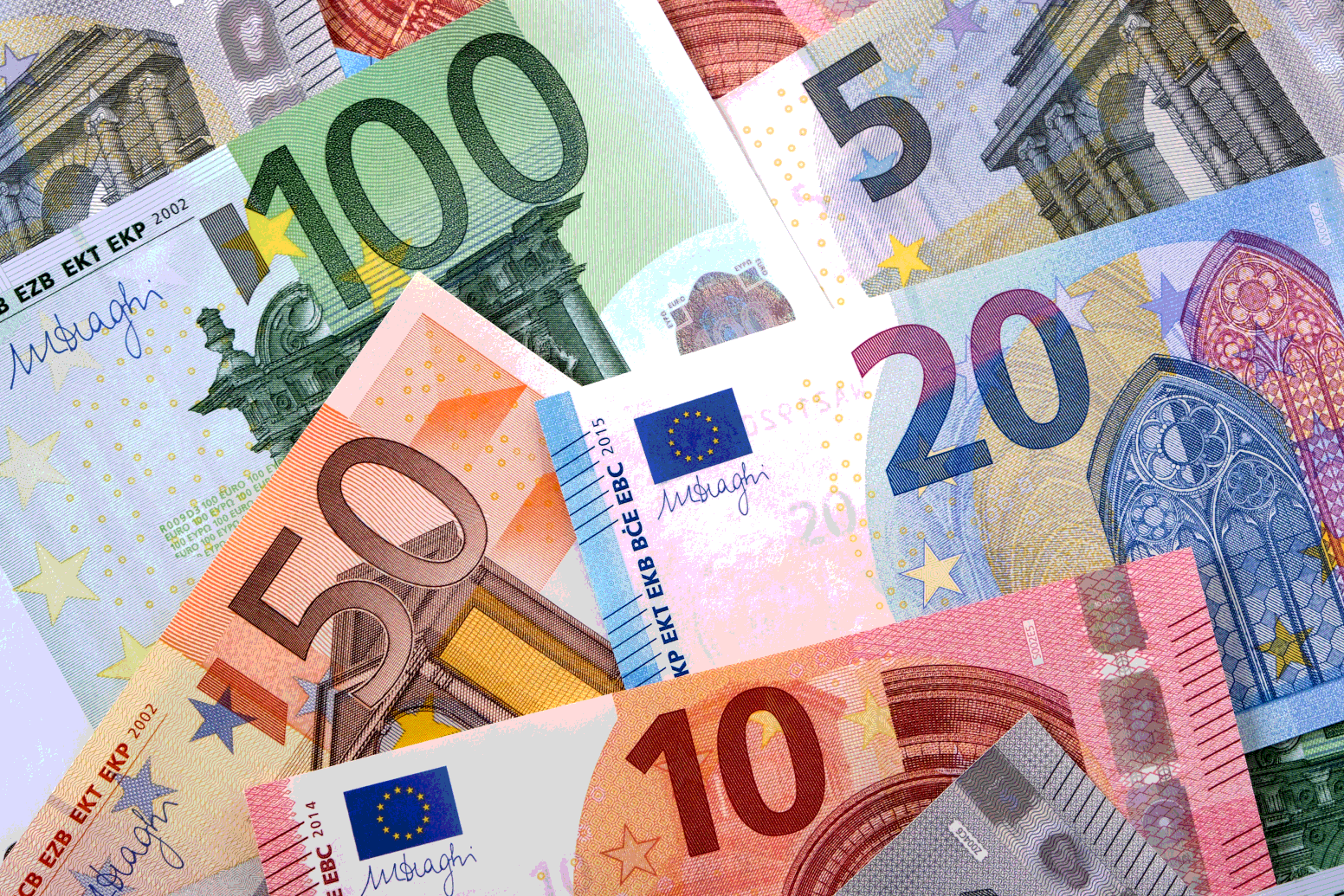

A more favorable exchange rate for you

Making it easier to do business across borders

At Zax Finance, we take the hassle out of international payments and foreign currency management.

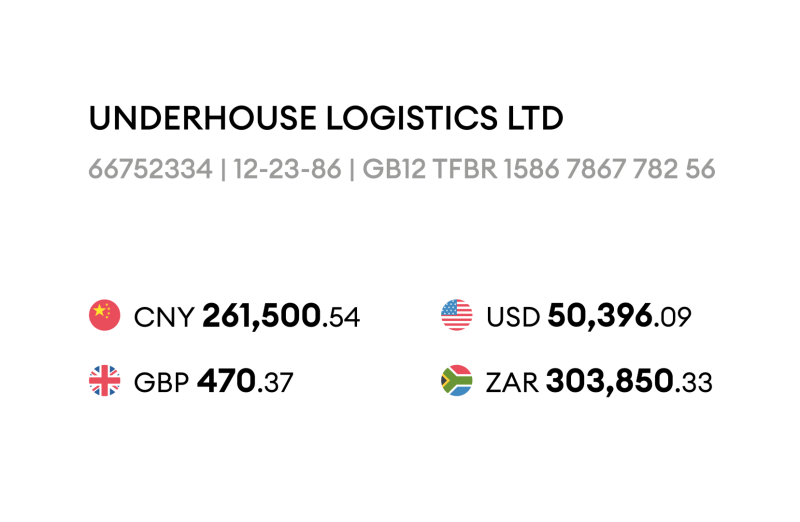

Multi-currency accounts for businesses

Security of your bank-level account

Fixing a transaction

at the current exchange rate

at the current exchange rate

A more favorable exchange rate for you

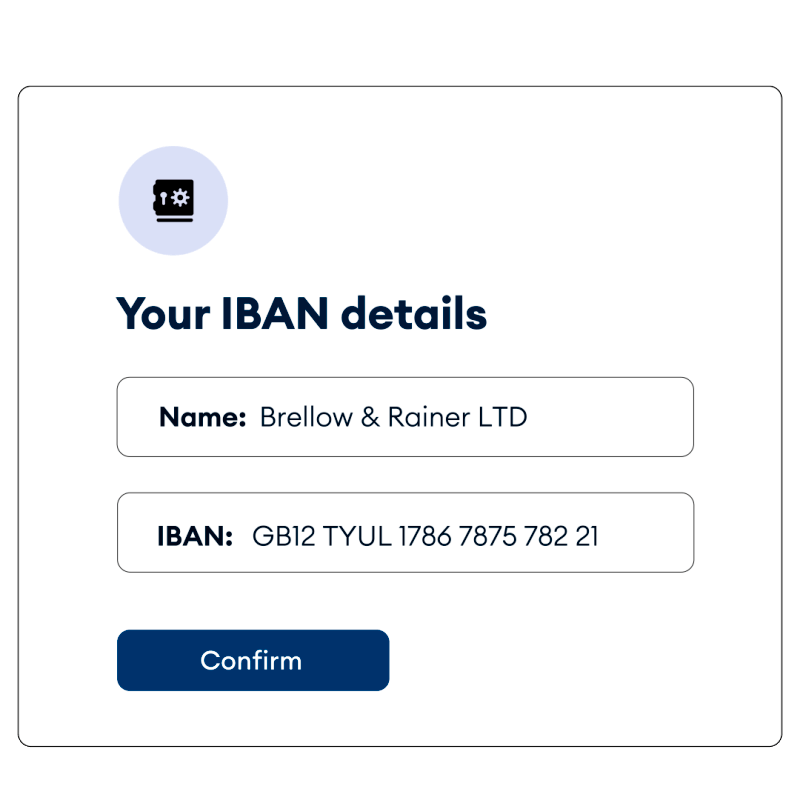

Individual IBANs in your name

When you sign up for a ZFS Online Account you’ll be assigned your own named IBANs. This helps you to establish further credibility with your own customers and suppliers. If your company needs multiple accounts, you can see all your IBANs, balances and details under one single login.

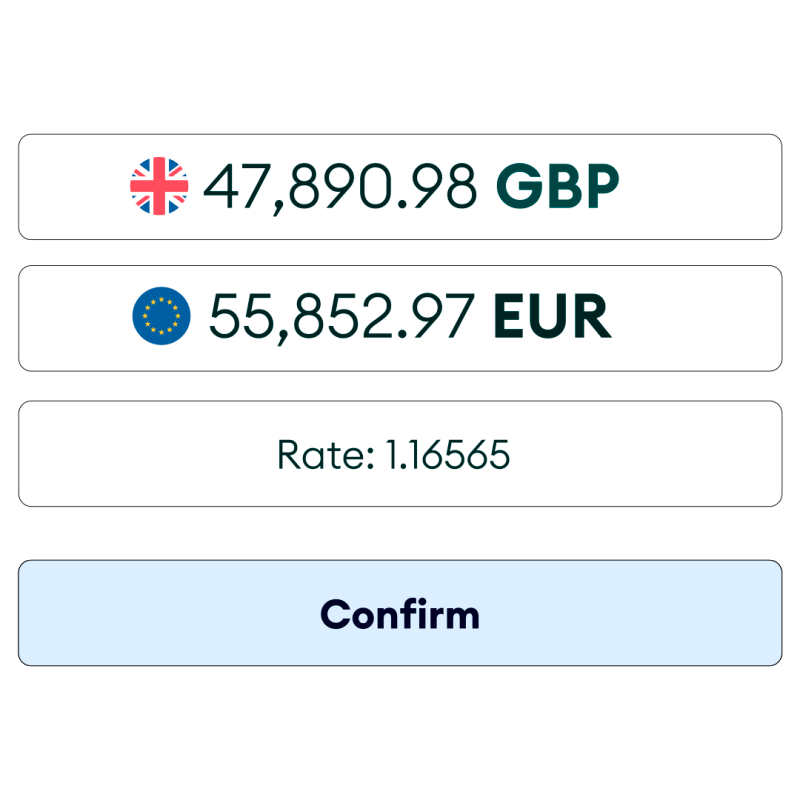

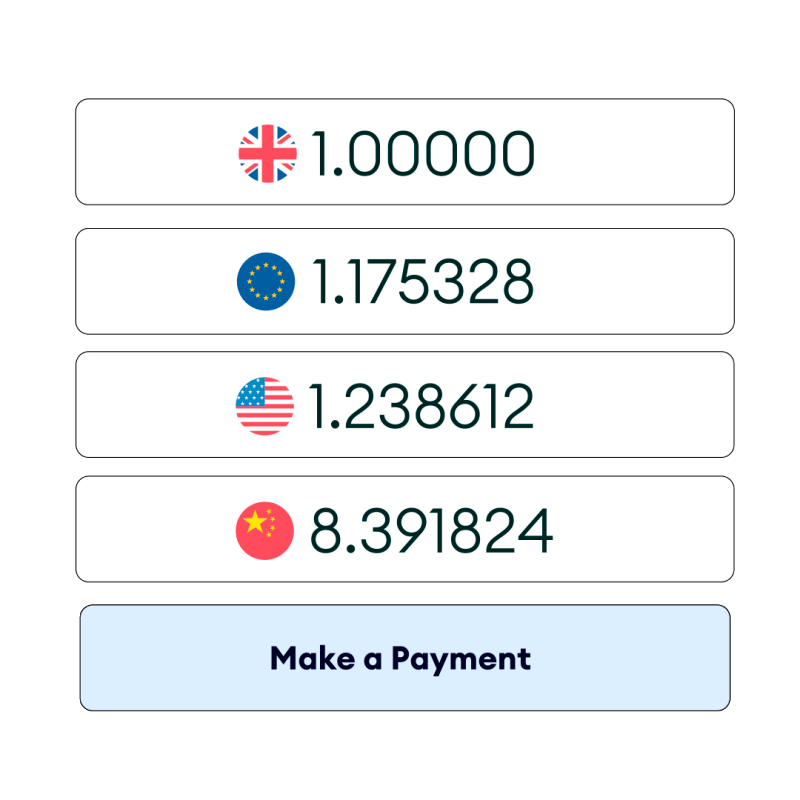

With a ZFS Online Account, you’ll get a much better exchange rate than if you use a High Street Bank. Unlike banks, we’re a lean and agile company that simply doesn’t need to charge the same fees or percentages to be profitable. We’re also able to access the currency markets directly.Bank beating exchange rates*

Bank beating exchange rates*

If the exchange rate is good now but you’re not quite ready to change currencies, you can use forward trades to lock in a transaction at the current rate and then complete it later when you’re ready to convert. You can easily see the live exchange rates in your ZFS Online Account.

Manage your Currency risk

With a ZFS Online Account, you can get paid directly into your own named account from overseas in over 25 major currencies, all without having to pay the high conversion and recipient fees associated with a bank.

Receive overseas payments directly

Stages of work

1

Account Registration

You create/register an online account by specifying your name, email address and mobile phone

2

Two-factor verification

Once account is registered you will be asked to do a two-factor verification - confirm email address and telephone number provided during registration

3

Questionnaire survey

You will be asked to complete a short questionnaire, and based on the information provided will be advised what documents they'll need to provide to process the application

4

Application consideration

Compliance team will review the

application and approve the account typically within 3-4 business days.

application and approve the account typically within 3-4 business days.

Permitted Jurisdictions

If the company is registered in - and the beneficiary is a resident in one of these countries, the process of opening an account is usually simple.

If the company is registered in one of these countries, but the beneficiary from a country that is not on the list – in this case, may request additional information, because this option will be considered as an "increased risk"

If both the company and the beneficiary from countries that are not on the list, this option will be considered as a "high risk", with a high probability of rejection.

If both the company and the beneficiary from countries that are not on the list, this option will be considered as a "high risk", with a high probability of rejection.

If the company is registered in one of these countries, but the beneficiary from a country that is not on the list – in this case, may request additional information, because this option will be considered as an "increased risk"

If the company is registered in - and the beneficiary is a resident in one of these countries, the process of opening an account is usually simple.

If both the company and the beneficiary from countries that are not on the list, this option will be considered as a "high risk", with a high probability of rejection.

If the company is registered in one of these countries, but the beneficiary from a country that is not on the list – in this case, may request additional information, because this option will be considered as an "increased risk"

If the company is registered in - and the beneficiary is a resident in one of these countries, the process of opening an account is usually simple.

Currencies in which you can keep money

When making large international payments, sometimes you need the personal touch

International payments can be complicated and expensive especially if you’re making a significant purchase of over £20,000.

Our personal and professional service means that you have support every step of the way. Our team based in the City of London is at the end of the phone to offer guidance on the FX markets and throughout the transactional process

We’ll get you bank beating exchange rates* on your major foreign currency transaction, typically around 5%. On large purchases like real estate we could therefore potentially save you thousands.

Our personal and professional service means that you have support every step of the way. Our team based in the City of London is at the end of the phone to offer guidance on the FX markets and throughout the transactional process

We’ll get you bank beating exchange rates* on your major foreign currency transaction, typically around 5%. On large purchases like real estate we could therefore potentially save you thousands.

Speak to us today and start making it easier to do business across borders.

Your money is in safe hands

We follow strict rules

We strictly adhere to the rules of providing financial services that are regulated by the Financial Supervision Authority

Banking-level security

We use the most reliable online security tools to keep your money, account and data safe

We fully share your funds.

Your funds are kept in a separate account and are used only for your currency needs.

All transactions are carefully checked

All payments go through a verification level to make sure they are valid transactions.

Quick and convenient access to your money. Manage your business finances quickly and securely in one app, wherever you are and whatever you do

Personal account

ONBOARDING

From £25

PAYMENT FEES

From £45

MONTHLY FEES

£0-35

Pricing

If Client makes no Forex transaction during statement period (month) an additional account turnover

maintenance fee of 0.025% of the processed amount will be assessed.

Get a free consultation

Do you have any questions? Write to us and our managers will consider your request as soon as possible and find the optimal solution, taking into account the specifics of your business.

By submitting an application, you agree to the processing of personal data in accordance with our privacy policy